indiana excise tax exemption military

The alcoholic beverage excise tax is imposed on all alcoholic beverages at a per-gallon rate paid by Brewers Wholesalers and Permittees in Indiana. The Indiana excise tax on cigarettes is 100 per 20 cigarettes lower then 62 of the other 50 states.

The amount of excise tax is the lesser of the following.

. The excise tax exemption is one of several bills implemented in recent years that benefit service members including two bills that took effect in 2020. If one spouse is a resident of Indiana and the other is not file a nonresident Indiana return. Phases in the exemption over four years beginning in taxable year 2024.

However Jones does point out that many people who are either. Indiana is not the. Indiana Income Tax on Military Retired Pay.

Whether registering a vehicle for the first time or renewing registration all customers pay an annual excise tax and a registration fee. The per-gallon rates are as follows. For taxable year 2020 Indiana resident Veterans are eligible for a deduction.

If you cant renew online you may need to print a Military Extension Letter. Indiana is in the process of exempting taxes on all military retired pay. What deductions are available to Indiana residents for military service.

Present a Leave and Earnings Statement LES showing your home of. A veteran who owns a vehicle and is entitled to a deduction under IC 6-11-12 sections 13 14 or 16 and has any remaining deduction from the assessed valuation to which. Visit the Indiana BMV website to renew your drivers license online.

The heavy equipment rental excise tax is. Model year 1980 or older passenger vehicles trucks with a declared gross weight of not more than 11000 pounds and motorcycles are charged a flat rate vehicle excise tax of 1200. The amount of excise tax determined by the Bureau of Motor Vehicles OR 70.

Indianas excise tax on cigarettes is ranked 31 out of the 50. Indiana is in the process of exempting taxes on all military retired pay. If you received a civil service pension nonmilitary and are at least 62 years of age then you may be eligible for up to a 16000 deduction.

A spouse of a nonresident military servicemember may not owe tax to Indiana on earned income from Indiana sources. I am serving on active military duty in the armed forces of the United States. The spouse may be eligible to claim a deduction if.

This type of equipment was previously subject to personal property tax however HEA 1323 2018 imposes this new tax type effective January 1 2019. Indiana is increasing tax exemptions and deductions for veterans with disabilities and military survivor benefits. You must have the form notarized or certified.

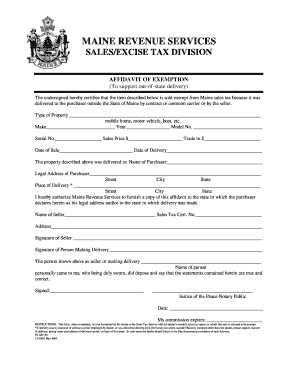

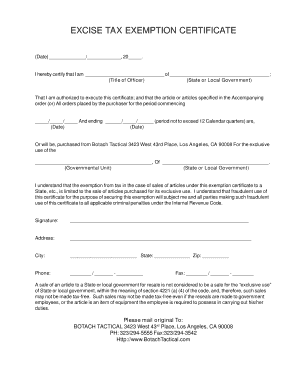

Complete an Non-Resident Military Affidavit for Exemption of Excise Tax. City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently. Beginning with tax year 2015 a.

It is not tax-free. Current law exempts from the individual income tax the military pay earned by members of the National Guard and. On the other hand if you are just temporarily.

Indiana Income Tax on Military Retired Pay. The first HB 133. Starting this year all survivor annuity payments are fully tax.

Passenger vehicles and recreational vehicles have. People who earn payment for working in the military pay state income taxes in Indiana. 31st highest cigarette tax.

The maximum number of vehicles an individual may. For taxable year 2020 Indiana resident Veterans are eligible for a deduction. To receive a military exemption from excise tax all of the following criteria must be met.

Oklahoma Business Incentives And Tax Guide Documents Ok Gov Oklahoma Digital Prairie Documents Images And Information

Kentucky Businesses Impacted By Sweeping Tax Reform

Wtb No 134 Wisconsin Department Of Revenue

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

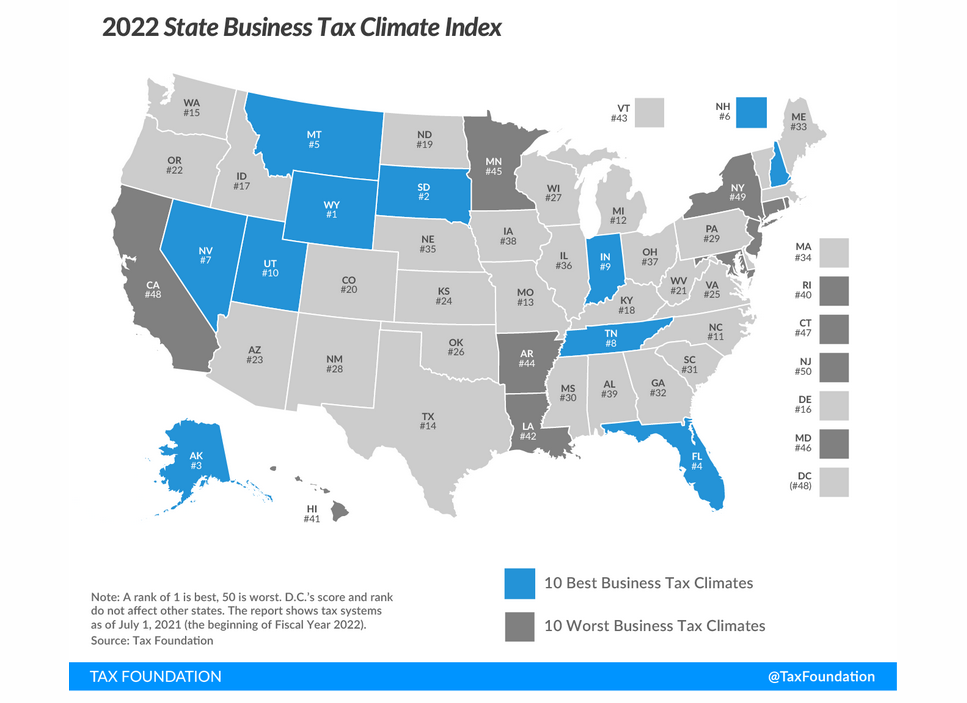

Indiana Maintains Top 10 Ranking For State Business Tax Climate Jobs And Employment Nwitimes Com

Indiana Military And Veterans Benefits The Official Army Benefits Website

Top 10 Indiana Veteran Benefits

Verify Indiana Military Retirement Benefits Will Soon Be Completely Tax Exempt Wthr Com

Indiana Military And Veterans Benefits The Official Army Benefits Website

Indiana Military And Veterans Benefits The Official Army Benefits Website

Bill Of Sale Form Maine Affidavit Of Exemption Form Templates Fillable Printable Samples For Pdf Word Pdffiller

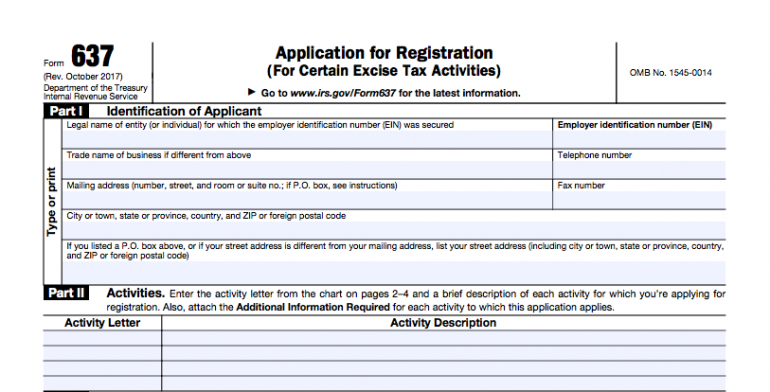

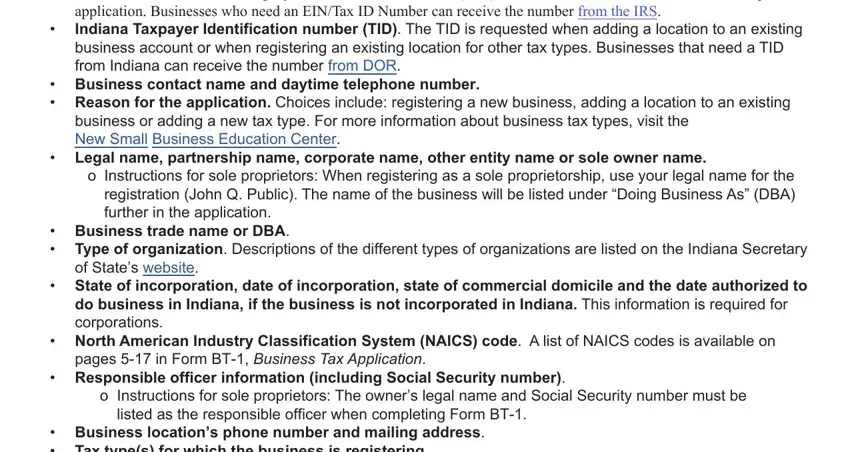

Form Bt 1 Indiana Fill Out Printable Pdf Forms Online

Indiana Military And Veterans Benefits An Official Air Force Benefits Website

Form 1040 Ez T Request For Refund Of Federal Telephone Excise Tax

Federal Excise Tax Exemption Certificate Pdf Fill Online Printable Fillable Blank Pdffiller

Indiana Military And Veterans Benefits An Official Air Force Benefits Website

Law Enforcement And Military Usa Barrett Firearms

Tax Guide For Military Members Veterans Military Service Related Exclusions And State Tax Benefits You Might Qualify For Moneygeek Com